*Unless otherwise specified all information has been obtained from the Etherisc website: http://www.etherisc.com

The global insurance industry with a valuation in excess of $4 trillion is at present, dominated by large corporations who face strict regulation and heavy misalignment of company and consumer incentives. As a result, the services offered by these insurance incumbents have become inefficient, ineffective, and provide little in terms of return on investment for end consumers. The primary source of misalignment stems from the fact that customers seek reimbursement on insurance claims from companies whose bottom lines are greatly dependent on avoiding payouts.

So, what does Etherisc propose as a solution to this pervasive issue? Decentralization of insurance applications. And, how does Etherisc plan to achieve this vision? Blockchain technology.

At a high-level, Etherisc is looking to use blockchain technology to make the purchase and sale of insurance services more efficient through lower operating costs for insurance providers, while also providing greater transparency into industry data through the democratization of access to reinsurance investments. According to the founders, blockchain technology provides a means to disintermediate the market through the development of a peer-to-peer risk platform that will help insurance service return to its intended purpose: providing people with a safety net. The start-up has thus far been able to successfully roll-out a decentralized insurance application for flight delays (DApp), which debuted at a global blockchain conference and provided industry experts with a glimpse of the capability and utility of Etherisc’s envisaged model.

To delve deeper into the feasibility of Etherisc’s vision, it is important to bridge the gap between the current state of affairs in the insurance industry and the company’s aspirations. As alluded to earlier, insurance providers offer customers with services that are not efficient or cost-effective. This observed phenomenon is primarily the result of insurance systems worldwide being greatly asymmetric. This asymmetry stems from customers having relatively low buying and bargaining power against insurance companies that have “reaction” power over these consumers. In order to combat the inherent power insurance companies possess, heavy regulation is imposed that create costly overheads for these companies, which ultimately get passed down to end consumers in the form of elevated premiums.

However, Etherisc believes that blockchain and smart contracts can address the aforementioned issues. Through the creation of smart contracts (a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract, while allowing the performance of credible transactions without the inclusion of third parties), the company envisions the need to trust a singular central authority (regulators and insurance companies alike). These contracts in conjunction with blockchain technology will essentially help naturally align the needs of society, dramatically ameliorate automation, and thereby eliminate several “non-value” added processes to bolster efficiency and cost-savings. The marriage of these technologies have lead Etherisc to envision an insurance system where underwriting and payouts will be based strictly on the use of hard data and algorithms. Definitely makes you think how much money you could have saved on insurance if this system always existed, right? Apart from the abovementioned, Etherisc’s proposed model is forecasted to help speed up product development through the creation of dynamic and flexible insurance application development over blockchain technology. Refer to Appendix A for prescribed benefits of decentralized insurance.

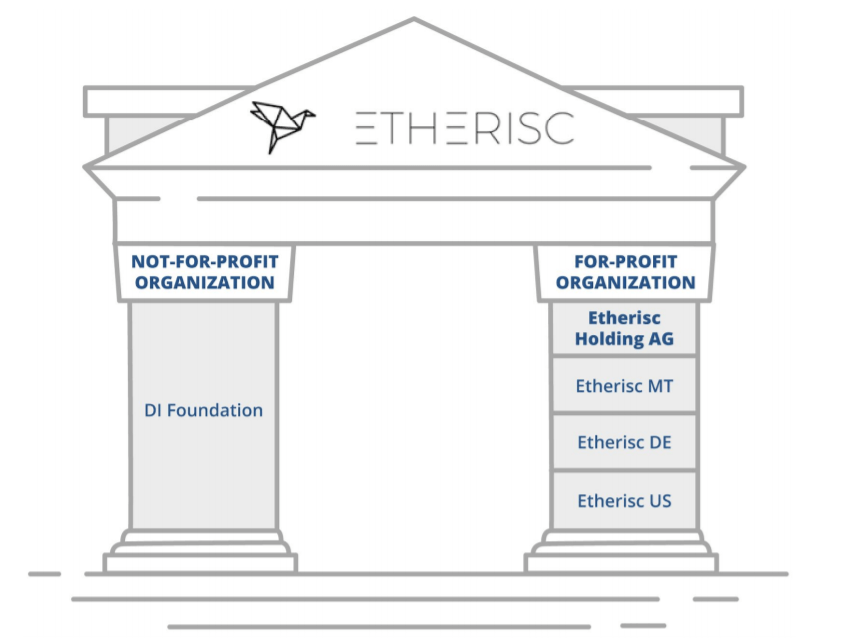

The platform currently being developed by Etherisc will be free, open-source, and open-access for decentralized insurance. The platform based off technical protocol and layered applications will essentially act as an ecosystem for all service providers within the insurance space such as insurance companies, risk modelers, claim settlement specialists, and more to operate. This begs the question, what’s in it for Etherisc? Etherisc plans to follow a “two-fold approach”; one fold which will operate as an independent, not-for-profit foundation, and a second fold which will consist of several commercial units which will possess the capability to generate money. The foundation, which will operate as an independent and neutral entity that will be responsible for carrying out its sole purpose of developing the open platform and its maintenance. The for-profit commercial entity will benefit from being the first-mover on the platform through feasibility testing of multiple applications which will help it earn revenue to aid the platform’s sustainable development. Refer to Appendix B for a visual representation of the company’s structure.

While Etherisc’s vision, if feasible, is admirable, the elephant in the room critical to achieving this goal surrounds regulation. As it currently stands, Etherisc’s vision has not yet been backed by regulators; primarily due to the novelty of the technology acting as the backbone to its successful execution, in an industry characterized by inefficiencies and limited innovation. The company has been in contact with regulators in multiple jurisdictions to provide background information on the benefits of blockchain technology in the insurance space. Furthermore, Etherisc has developed a multi-step plan to limit the impact of regulator backing on the use of its platform including pairing with licensed insurance partners until the company’s products obtain regulatory licenses.

Finally, comes the question of funding? How? How much? The company set a goal of raising several million dollars through token-generating events (TGE) in 2018 and 2019, which would entail the issuance of DIP (decentralized insurance protocol) utility tokens that were of limited supply. The company successfully issued all the tokens in supply, proving to be a sign of the strong belief in the company’s vision from investors. These funds have been used to expand operations, further develop the protocol and gateways, and to fulfill Solvency II capital requirements (formal governance requirements in the insurance space mandating roles such as a risk management, independent audit, and actuarial, and compliance functions to name a few).

While Etherisc still has considerable ground to cover in actualizing its vision, certain realities cannot be denied. Insurance companies continue to take advantage of consumers using strong bargaining power. Decentralization of insurance services theoretically improves variety, quality, and efficiency of services that could be used by society as a whole. Investor belief, which is a reflection of general market sentiments shows strong support and conviction in Etherisc’s vision. While regulation is a hurdle that inevitably has to be conquered by this innovative company, if successful, Etherisc can very likely change the insurance industry as we all know it.

Appendix A: Proposed Benefits of Decentralized Insurance

Source: https://etherisc.com/#own-token (within company slide deck)

Appendix B: Etherisc – Business Structure

Source: https://etherisc.com/#own-token (within “What Is Etherisc” document)