Diamonds have long been considered a symbol of everlasting love, commitment, and romance; however, a diamonds past is rarely flawless. The value chain of the diamond has long been fraught with complexities and controversy, and continues to drive issues in the supply chain from mining to retail. With the rising popularity of decentralized technologies and blockchain, this historic industry has the opportunity to thrive in the digital era.

The traditional diamond industry is characterized by a variety of issues. First is the lack of uniformity within the industry for rare stones, as there has traditionally been no standardized procedure for pricing and distributing diamonds. There is a high knowledge barrier, and it is capital intensive for an individual to consider getting into the diamond purchasing market. This combined with a lack of regulation leaves the market vulnerable to cons and faulty monetary transfers while obtaining the commodity.

The second problem is the is the lack of a stable, traditional financial market for diamonds and precious gems. Diamonds are typically passed through the hands of various dealers, making it exceptionally difficult to assess the true state and origin of the stone. Diamond dealers don’t have a standard measure of how much the diamonds they have are worth and are unable to hedge their investments and protect themselves against potential losses. A decentralized market would give the wider public access, allowing features such as a formal directory, standardized prices, and a platform for global investments, making diamonds a safe and lucrative asset to invest in (source).

Both of these fundamental issues can be overcome with the integration of blockchain in the diamond industry. While blockchain has gained popularity as the foundation of cryptocurrencies such a Bitcoin and Ethereum, its ability to act as a decentralized ledger and record any type of transaction has allowed other industries to adopt this technology for its own uses. Information on the blockchain is cryptographically proven by a federated consensus, instead of being written by an individual (source).

It is posited that by using blockchain technology to decentralize the diamond trade, a full-fledged financial market can be made for the rarest of commodities, solving current issues with standardization and banking, while expanding the market and driving the prices of the rare stones up (source). By allowing digital information to be distributed but not copied, blockchain technology is instrumental in creating the backbone of a new type of supply chain in the industry. The technology dramatically decreases the importance of traditional bookkeeping and ensures tracking of which individual is accountable for delivery at each handover within the value chain.

Blockchain will allow firms to create and implement a ledger that would trace stones from the point they are mined up to when they are sold to consumers. This is an industry dealing with complex, multi-level supply chains that tend to include numerous steps and hundreds of geographical locations around the globe. This is a particularly sensitive subject in the diamond industry due to the prevalence of blood diamonds.

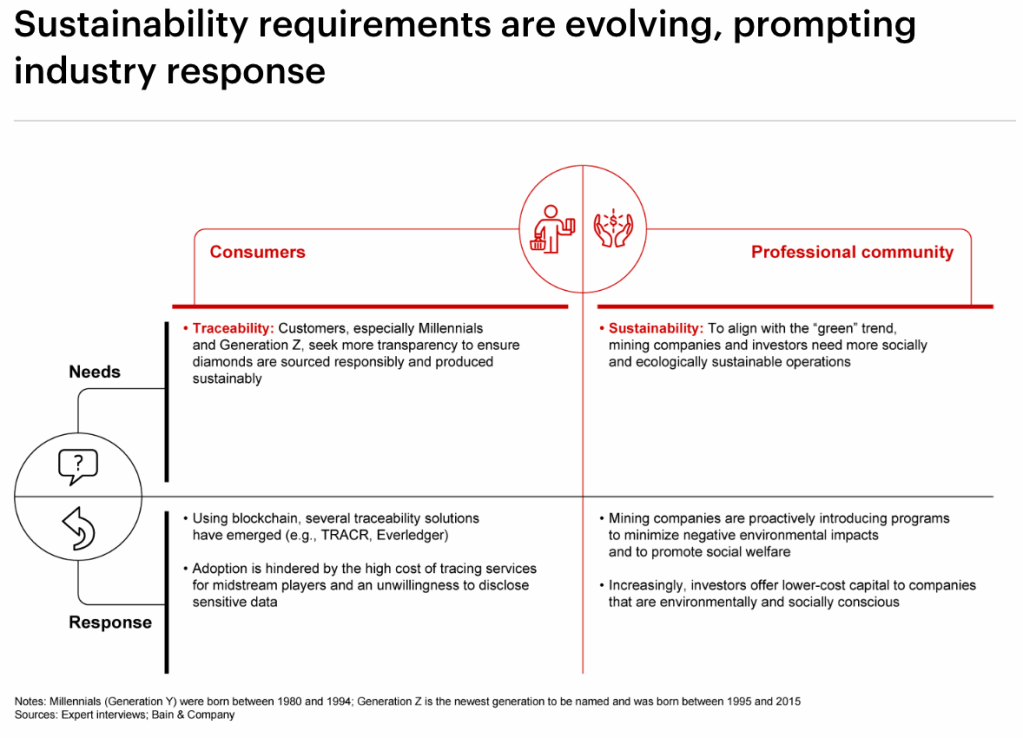

Blood diamonds, or conflict diamonds, has been a long-running concern in the industry. Retailers are finding that consumers are becoming more aware of the sustainability of their diamonds and are demanding reassurance that stones they are buying have been ethically sourced and are conflict-free. The international diamond market has taken steps to eradicate conflict diamonds through initiatives such as The Kimberly Process in recent decades, however fraud and falsification is still an ongoing problem.

As blockchain technology is backed by a highly sophisticated encryption system, only those with permission (in this case those in the supply chain responsible for overseeing the mining, cutting, wholesale and retail of the precious stones) can enter or edit data within the database. This gives the strongest reassurance that stones which are certified as conflict or child-labor free are accurate. The decentralized nature of the ledger ensures that anyone can see the movement of the stones in question and know their origin, while having confidence that the record wasn’t altered by any parties attempting to profit by passing off conflict diamonds or fake precious stones as genuine (source).

There are various technologies led by firms that are at different stages of development, which aim to leverage the decentralized nature of blockchain in the diamond industry. Agile digital adoption can also improve logistics and demand planning for said firms.

DeBeers, one of the world’s oldest and largest diamond conglomerates that specializes in diamond exploration, mining, and retail, announced that it planned on leveraging blockchain technology to improve the transparency of the diamond value chain, and get permanent digital records for every diamond registered on the platform (source). DeBeers collaborated with technology and industry leaders to ensure the platform is inclusive and meets the needs of all users. During the development phase, key considerations being addressed included “the protection of commercially sensitive data, streamlining processes at various stages of the value chain, and providing further assurance for those that finance the industry” (source).

On the other end of the spectrum there is Everledger. Founded in 2015, Everledger is a global digital registry for diamonds powered by distributed ledger technology (DLT). The firm has uploaded unique identifying data on a million individual diamonds to a blockchain system to build quality assurances and help jewellers comply with regulations barring “blood diamond” products (source). The firm has expanded its focus from polished diamonds to newly mined stones, ensuring Everledger can monitor conflict diamonds, which frequently make it into the market in their uncut form.

While some see blockchain as technological trend, the market for precious gems and diamonds have deep rooted issues that the decentralized technology could solve for the first time since the industry’s inception. If incumbents can pivot to incorporate these architecturally innovative solutions, there could be a lasting impact on the business as a whole.

Appendix A