So What Is Decentralized Finance or De-Fi for Short?

De-Fi is an ecosystem of financial applications that are built on top of blockchain networks. Traditionally, finance is highly regulated by the government and is conducted through a central entity, the central bank. Central Banks around the world regulate the economy through the use of monetary policies such as Discount Rate, Open Market Operation and/or Reserve Requirement. Central Banks serve as the bank for private banks and the government1. The banks is then able to extend lending to their clients.

De-Fi is a movement that aims to create an open-source, persmissionless and transparent financial ecosystem that is peer-to-peer without a central authority, giving individuals complete sovereignty over their assets. De-Fi applications differ from traditional lending as they abstract away any intermediaries (banks) or arbitrators. The applications use code to specify the conditions in a deterministic way to resolve disputes2. Essentially, everyone can act as his/her own bank and lend to anyone as he/she sees fit, providing flexibility and financial access to the “unbanked”.

The Status of De-Fi Today

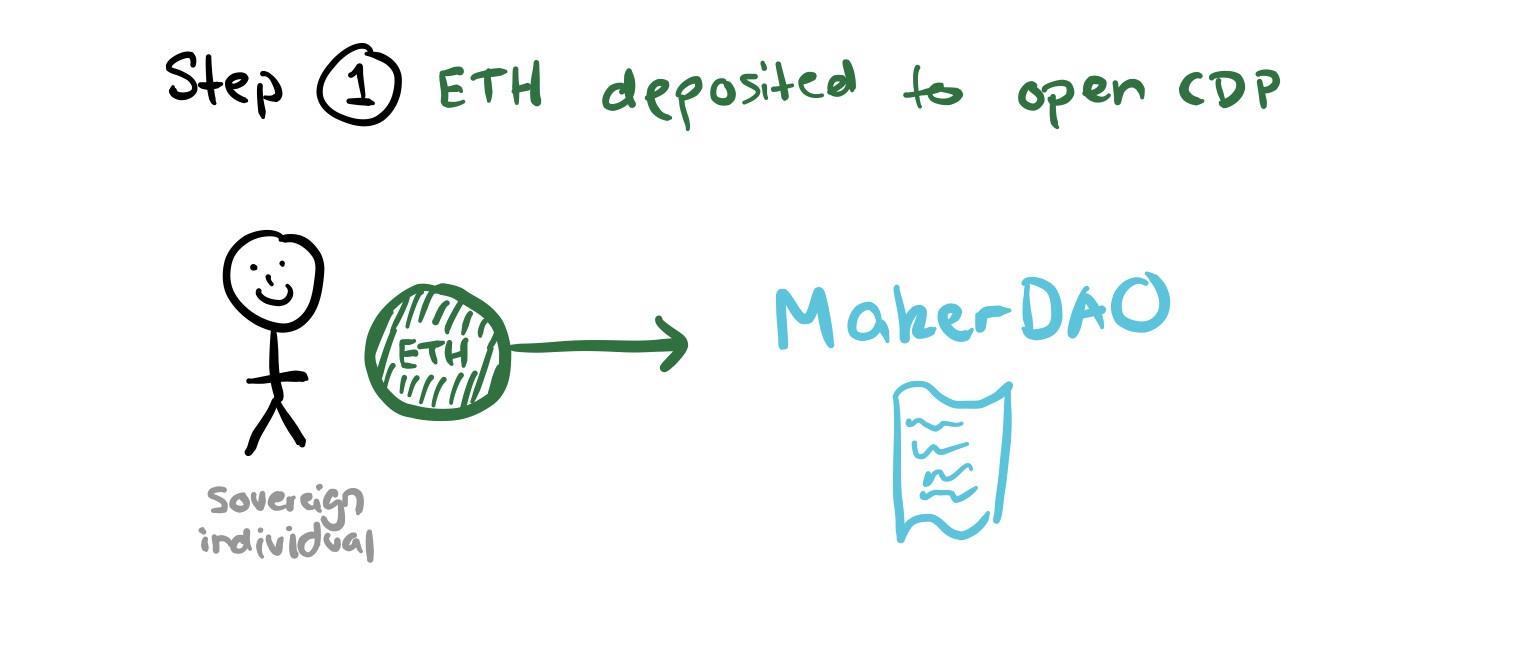

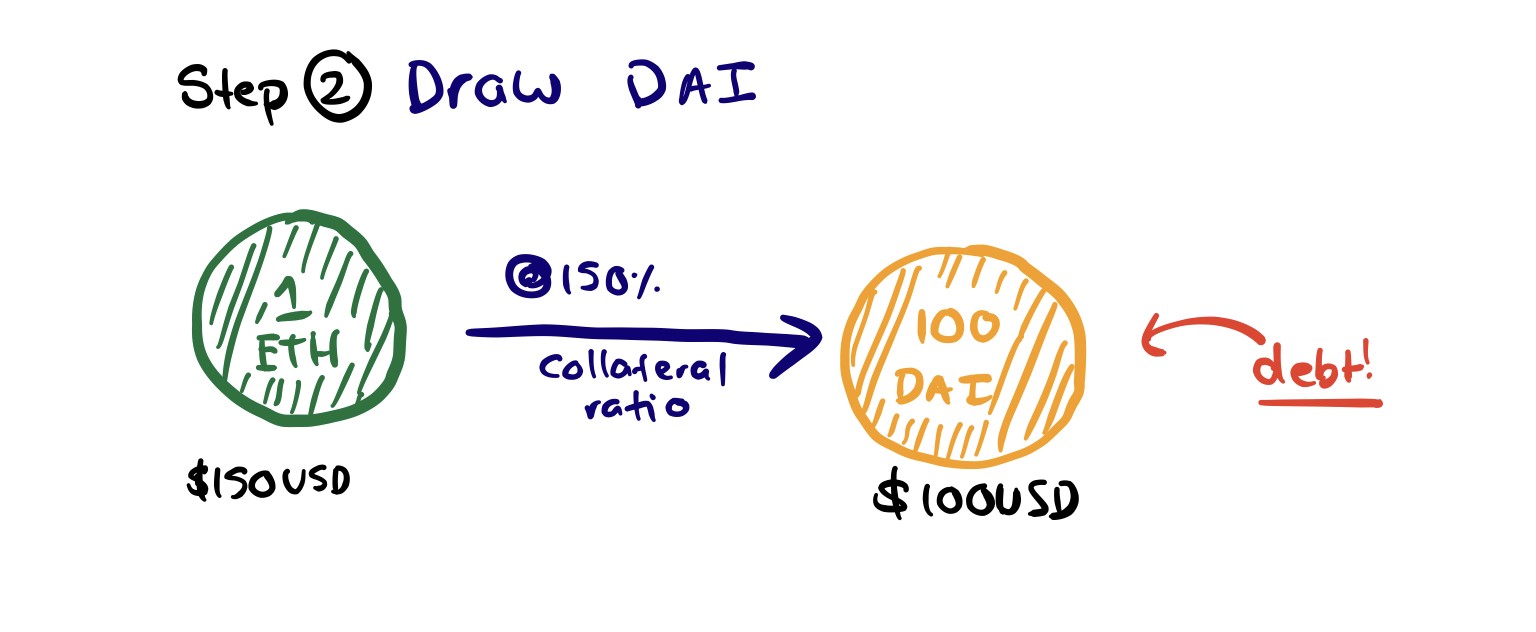

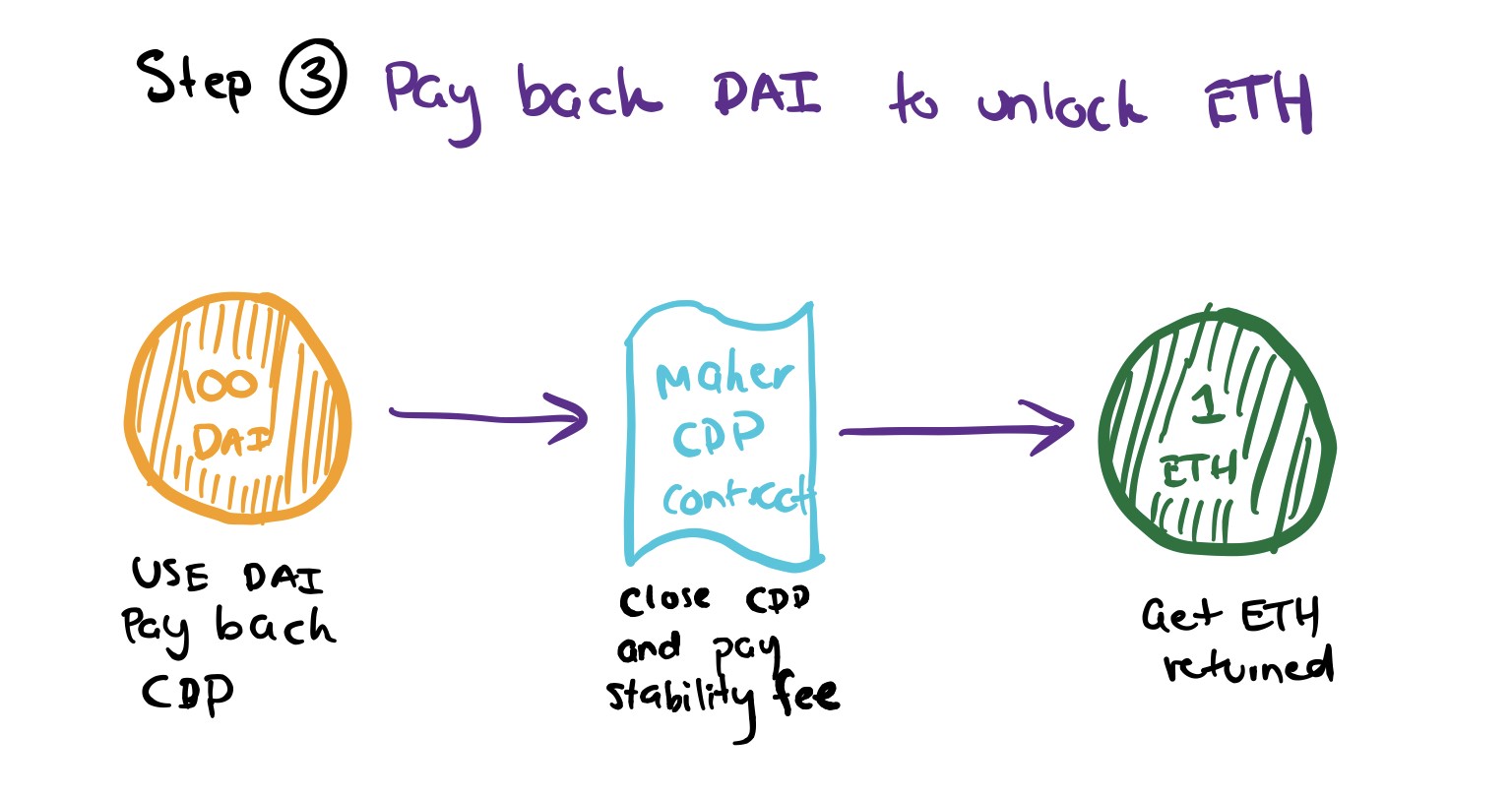

Today, majority of the De-Fi application is built on top of the Ethereum platform, leveraging its smart contract capability. Collectively, the collateral that is locked on De-Fi based application approached $1 Billion USD on Feb 7th, 20203. The top three protocol in this space are Maker ($597M), Synthetix ($149M) and Compound ($125M). So what is Maker? Maker protocol allows individuals to borrow Dai, a stablecoin that is pegged to USD (1Dai = 1USD), by collateralizing ETH. Multi-collateral digital assets are currently under development, and recently, the Maker community voted to integrated BAT as a collateralizable asset. Sai is the stablecoin generated from the multi-collateralized asset.4 It is also pegged one to one USD. At its initially phase, the collateral coverage ratio is set at above 150% to ensure coverage on the system as there is no credit scoring on the ecosystem yet (Collateral Coverage Ratio = Collateral Value/Total Loan Amount).2 For more details, please refer to the MakerDao Whitepaper or Maker Protocol Presentation.

Source – Kohli, K. “What’s MakerDao and what’s going on with it? Explained with pictures,” Accessed Feb. 9, 2020.

Compound, on the other hand, facilitates peer-to-peer lending by creating money markets for various tokens, existing on the Ethereum Blockchain. Each market is linked to a cToken which acts as the intermediary for the respective asset being lent on the protocol. Through the cToken, lenders earn interest that compounds over time. Interest rate fluctuates based on supply and demand dynamics. For more details, please refer to the Compound Whitepaper.

Disruption to Economic Norms?

Being an “architectural innovation” where it fundamentally reshapes the existing lending/borrowing business model by allowing peer-to-peer lending/borrowing and leverages the blockchain technology5, the movement can offer an alternative to the economic norms of today. As modern economy is centred around the Keynesian School of Economics, Central Banks and Governments use monetary and fiscal policies to stimulate growth through increasing aggregate demand by means of government and consumer spending, business investment and net export1. Although it has been shown to be effective at stimulating growth, especially during World War II and the Great Financial Crisis of ’09 when business and consumer confidence is low, inefficient and unfair deployment of capital and the suppression of market price discovery have been argued by many opponents of these entities. Since the Financial Crisis, the Austrian School of Economics has garnered interests as the bail out of large financial institutions has stoked public dissent. Austrian economists believe that saving and production drive growth and that interest rates are determined by the time preference of borrowers and lenders instead of a central authority. The Austrian School also views that business cycles are caused by the distortion of interest rate set by the Central Banks6. In essence, Keynesian economists approach the economy from the top down while Austrian economists favour a bottom up approach. See Figure 1 for infographic between the two approaches.

So what is the implication of De-Fi to the existing world of finance?

Pivot back to De-Fi, the movement uniquely enables this bottom up approach by providing the technology to easily and seamlessly connect lenders and borrowers remotely and efficiently. This ability is made possible by the creation of blockchain technology where individuals can foster trust digitally. It is difficult to forecast how the movement will unfold as it is still nascent. It is entirely possible for both system to co-exist and thrive as there are merits to either approach. This boils down again to the concept of to centralize or not to decentralize. There is no right or wrong choices, but it is the situation and the timing that justify the deployment of one over the other.

Corporations in the financial sector, however, should closely monitor the development of De-Fi. It is interesting to note that Compound (mentioned previously) ,an extension of Circle, is backed by Goldman Sachs.7 Goldman is actively involved in the space in a strategic way to bring architectural knowledge to the top by working with this new technology. By being a dominant and influential player in the De-Fi space, Goldman can establish industry norms and form end user relationships that are different from other parts of their business, securing their market position in the event that the market pivots away from traditional finance. The crypto currency ecosystem is thriving and innovating at a rapid pace. The openness of the community allows innovators to experiment different methods of financial models and governance that are extremely difficult to achieve in the highly regulated financial infrastructure of today. The future is exciting and everyone should watch closely as the space unfolds.

Figure 1. Keynesian Economics Vs. Austrian Economics

Sources

- Board of Governors Of The Federal Reserve system. “Quarterly Report on Federal Reserve Balance Sheet Developments, November 2014,” Accessed Feb. 2, 2020.

- Binance Research (Etienne, C). “DeFi Series #1 – Decentralized Cryptoasset Lending & Borrowing,” Accessed Feb. 5, 2020.

- Huillet, M. “Value Locked in Crypto DeFi Markets Hits $1 Billion Milestone,” Accessed Feb. 5, 2020.

- Turley, C. “Maker,” Accessed Feb. 5, 2020.

- Corning; Pisano, G. “You Need An Innovation Strategy, June 2015,” Accessed Feb 8, 2020.

- Hall, M. “The Austrian School of Economics,” Accessed Feb. 8, 2020.

- Circle. “About,” Accessed Feb. 8, 2020.