The impact of decentralized financial services

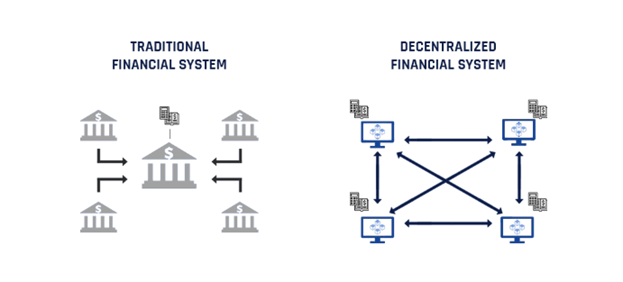

Over time, technological developments and their rapid adoption, and today, the decentralized financial system have made wealth-building tools more accessible to everyone. The internet created an underlying pipeline for global communication, the proliferation of smartphones created an opportunity for the financial service institution to provide faster and more convenient service to customers to the extent they are more comfortable with handling their finances online. Nowadays, digital banking is a necessity, not a possibility. Finally, blockchain technology and digital currencies are building a new decentralized financial system. The unique qualities of public blockchain which differentiate it from the private network can make the decentralized system a proper alternative system for financial institutions.

Qualities of public blockchain

1- Permissionless: everyone has access to the services regardless of their wealth, status, or location

2- Decentralization: Instead of a central server, the records are simultaneously kept across thousands of computers.

3- Trustless: there is no need for a central authority to validate the transactions.

4- Transparent: Everyone can see the entire transactions happening in the blockchain.

5- Censorship resistant: Transactions are immutable.

6- Programmable: developers can program business logic into low-cost financial services. [i]

They are an estimated 1.7 billion people considered excluded population because regardless of the existing infrastructure, those people still don’t have access to financial services. Decentralization creates an opportunity for anyone with a smartphone to access financial services at lower costs. Because the decentralized system is permissionless and open to anyone, everyone has access to the financial services regardless of their wealth, status, and location.

Considering the advantages of decentralization, can we consider decentralized finance a more desirable alternative for traditional banking?

The decentralized financial system is rapidly changing various aspects of finance such as retail and wholesale payments, financial market infrastructures, investment management, insurance, credit provision, and capital raising. It is reshaping the entire financial sector, as it is evident through the rise of the global investment in FinTech to a record of US$112 billion in 2018. However, there are still many uncertainties to solve.[iii]

Although decentralized finance could simply transform the lives of many people, there are still various concerns and risks involved with a decentralized system that makes it difficult to be considered as an absolute substitute for traditional banking. That is why the decentralized solutions have failed to gain public awareness despite the fact that Blockchain was invented in 2008 to serve as the public transaction ledger. According to a study published by the Cambridge Center for Alternative Finance back in December 2018, even though there are 1.7 billion unbanked people in the world as I mentioned earlier, they are only 25 million verified crypto users worldwide. [iv] Enthought this number has rapidly increased to over 42 million, as of September 2019[v], it is still very difficult to forecast the future demand for cryptocurrency.

The implications of decentralizing the financial services systems through innovations such as blockchain technology, crowd funding, and peer-to-peer funding are controversial. Many industry leaders believe the benefits of these innovations outweigh the risks and others believe these decentralizations pose novel risks to the financial system. In this article, we will investigate the advantages and disadvantages of decentralized financial services system to better understand what to expect in the near future. [vi]

On one hand, the decentralized system reduces the systemic importance of certain financial institutions and therefor enhances competition and diversity, on the other hand, decentralization could create some uncertainty regarding accountability and legal liability and therefore could increase volatility in the provision of credit. Also, decentralization could expand opportunities for regulatory arbitrage by undermining traditional supervision of centralized financial institutions and therefore could make regulation more difficult and could undermine confidence in the financial system. [vii]

The uncertainties in regard to consumer protection and the determination of legal liability affect consumer’s trust and ultimately makes it more difficult for the decentralized financial system to become mainstream.

There are concerns to be addressed before decentralized finance becomes mainstream and adopted by a larger number of users. These issues range from barriers to mass-adoption and user acquisition to consumer protection and legal liabilities. The decentralized financial system is dependent on the maturity and development of the blockchain industry to be able to mitigate the current scalability challenges and to handle large transaction volumes at a low cost. Powerful traditional players such as Visa are capable of processing 24,000 transactions per second, however the most prolific decentralized financial platform, Ethereum, is only capable of processing a limited number of transactions (10-30 transactions) per second, therefore, there are many areas for improvement.[viii]

What steps can financial regulators take to mitigate the risks?

To mitigate these risks, the Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, encourages regulators to broaden their horizons and work closely with a wider group of players, such as technology-sector firms that have limited interaction and inadequate cooperation with financial regulators. These engagements among various groups can prevent the appearance of some unexpected challenges and complications in the financial technologies around the globe. v

The close cooperation among these main players would provide an opportunity to identify the risks they face and to properly evaluate, communicate, and address them.

What can banks do to compete in this new decentralized environment?

- Utilizing data and AI to provide personalized solutions to transform and improve consumers’ experience and create real value for consumers.

- Employing an Intelligent Assistant and using voice commands to create a quick and convenient experience for consumers.

- Improve technical expertise to implement Open banking (implementing open API platforms) to enable third-party developers to build applications and services around the financial institution.

- Improve Cybersecurity of the organization to effectively protect customers’ information and manage cybersecurity risks.

- Implementing cloud technology to automate operations and increase efficiency, security and reduce costs. [ix]

What to expect in the future?

As the decentralized financial system continues to disrupt traditional banking and the traditional players realize the potential that decentralization can completely transform the existing financial system, the traditional players may shift their mindset and their regulations.

In the future, we can expect close collaboration among disrupters (technology firms), and financial services and regulators (traditional players). The decentralized finance ecosystem is characterized as an efficient, affordable, transparent, accessible, and secure financial system that empowers users, and all these qualities can effectively be utilized when technology firms and financial regulators collaboratively strive to create a more productive financial environment for customers in a modern world.

References

[i] https://www.visualcapitalist.com/decentralized-finance/

[ii] https://medium.com/stably-blog/decentralized-finance-vs-traditional-finance-what-you-need-to-know-3b57aed7a0c2

[iii] https://www.fsb.org/wp-content/uploads/P060619.pdf

[iv] https://cointelegraph.com/explained/decentralized-finance-explained

[v] https://news.bitcoin.com/the-number-of-cryptocurrency-wallets-is-growing-exponentially/

[vi] https://www.advisor.ca/news/industry-news/fintech-decentralization-pose-risks-report/

[vii] https://ncfacanada.org/fintech-decentralization-pose-risks-report/

[viii] https://www.nasdaq.com/articles/in-2020-will-decentralized-finance-finally-flourish-in-a-centralized-world-2019-11-27

[ix] https://thefinancialbrand.com/80496/financial-technology-trends-data-ai-digital-blockchain-cloud/