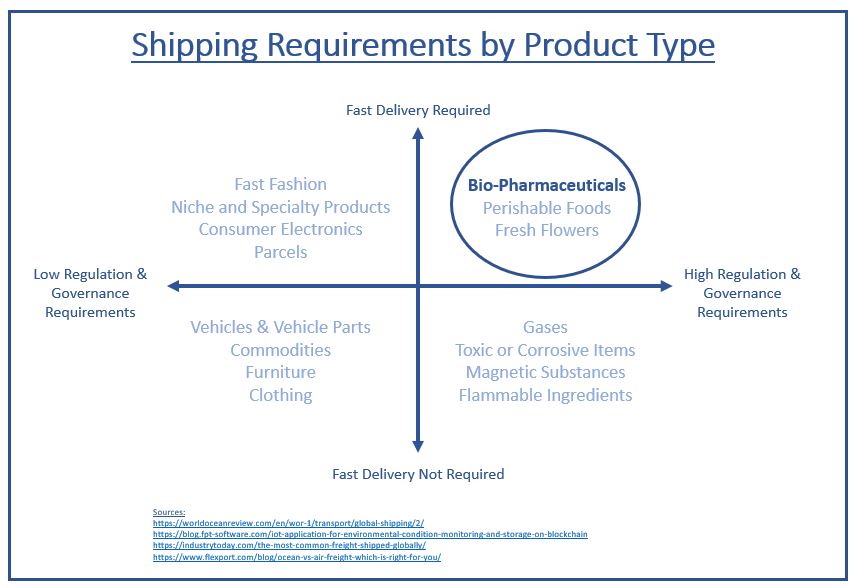

Compared to most products, bio-pharmaceuticals require advanced shipping methods such as expedited delivery and temperature-controlled shipping due to their temperature sensitivity and biological properties (Freight Waves, 2018, National Center for Biotechnology Information, 2018).

In 2019, the global bio-pharmaceutical shipping industry reached $15.7 billion, with sales of all temperature-controlled pharmaceuticals (the “cold chain”) expected to grow 59% by 2023 (Pharmaceutical Commerce, 2019). The scale of the industry and the anticipated growth in bio-pharmaceutical shipping poses several challenges for the pharmaceutical industry and logistics providers.

The sensitivity of these products combined with the temperature control issues present in existing supply chains has resulted in losses of approximately $35 billion annually for the pharmaceutical industry (Air Cargo News, 2019). It is also estimated that 40% of vaccines shipped around the globe have been compromised as a result of temperature fluctuations during shipping (Freight Waves, 2018). In addition to temperature-control issues, the pharmaceutical shipping industry is plagued with counterfeit drugs and increasingly cumbersome regulations. Scott Mooney, Vice President of Distribution Operations at McKesson U.S. Pharmaceutical noted that the risk of counterfeited drugs is increasing due to the prevalence of internet based ordering and the global delivery of products (National Center for Biotechnology Information, 2018), both of which will continue to grow in the future. Additionally, more stringent regulations established by agencies such as the Federal Drug Administration and the U.S. Department of Transportation are forcing companies to improve the traceability of pharmaceuticals and upgrade their temperature-controlled shipping processes (National Center for Biotechnology Information, 2018, Sensire, 2018). Counterfeits, regulatory burdens and poor temperature control can result in: unsafe drugs due to changes in drug composition, a rise in claims against pharmaceutical manufacturers, inconsistent trial results, and delays from an inability to meet regulatory requirements (Clinical Trials Arena, 2017). The sales growth of temperature-controlled bio-pharmaceuticals will dramatically increase the demand for secure, reliable and regulatory compliant shipping methods as international shipping of these products becomes ever more prevalent (Purolator International, 2018).

In response to these cold-chain issues, transportation carriers and third-party logistics providers have been piloting solutions involving the Internet of Things (IoT) and blockchain technology (Computer World, 2019). The IoT can help monitor temperature sensitive shipments by tracking temperatures, arrival times and the status of parcels as they move through the cold-chain (IBM, 2020). This is done using sensors placed inside packages or transportation vehicles that are able to detect information such as temperature fluctuations, package integrity, and vibrations (Computer World, 2019). In the event of temperature fluctuations, sensors will be able to provide alerts that the transportation environment is unsafe (Air Sea Containers, 2019). They would also be able to remotely activate cooling equipment (if present) in an effort to keep packages within acceptable temperature ranges (Air Sea Containers, 2019).

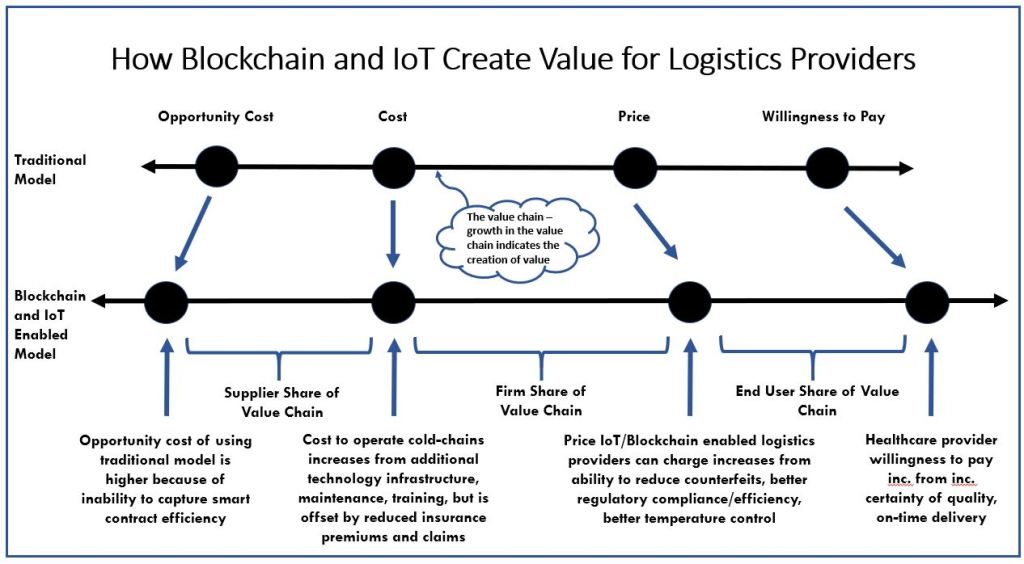

To fully optimize the cold-chain, data captured by each sensor will be sent to a blockchain ledger for record keeping. The immutable nature of the blockchain will allow each permissioned user to see the exact shipping history of a bio-pharmaceutical product, providing transparency to all stakeholders in the supply chain (UPS, 2017). This has the ability to: reduce unidentified counterfeits by improving traceability, reduce high insurance premiums arising from a lack of continuous monitoring and inspection by improving record keeping, and improve the efficiency of the supply chain by eliminating cumbersome administration documents and procedures (i.e. bills of lading, customs forms) (Winnesota, 2020, FTP Software, 2019). Using the blockchain to streamline regulatory review and compliance through the implementation of smart contracts will also reduce the cost to logistics providers from late or rejected goods (Clinical Trials Arena, 2017).

As a result of these benefits, IoT/blockchain technology creates significant value for all players along the bio-pharmaceutical value chain, while allowing logistics providers to capture a greater share of that value.

FedEx, UPS and DHL, the top three logistics companies in terms of sales revenue (Statista, 2018), are so bullish on the technology that they are pushing for the adoption of industry-wide blockchain standards for international shipping (Computer World, 2019). What is truly interesting is that even though the technology is still very new to the shipping industry, DHL, FedEx and UPS are looking to mandate it across all carriers. The introduction of this radical innovation means that although transportation carriers and third-party logistics providers will continue to operate under their existing business models, new technical competencies will be required to properly integrate and operate IoT/blockchain technologies. The fragmented nature of the logistics industry (Business Wire, 2020) means that organizations will vary in their ability to quickly and successfully acquire new technical competencies to effectively implement this technology as a truly end-to-end supply chain solution (Computer World, 2019).

In the area of life sciences, FedEx, UPS and DHL have a distinct competitive advantage that derives from their scale and skilled workforce. As noted by David Goldberg, the CEO of DHL Global Forwarding USA, “in the life science area we have the facilities, the people which are trained, and so we have the competency to be able to handle those shipments” (TT News, 2019). Combining their ability to access capital to invest in new technologies and their competitive advantage in life sciences shipping, they will be able to capture significant value from the growth of the cold-chain shipping industry.

Although shipping companies have mastered single supply chain tracking, shipping a product internationally requires companies to rely on a number of carriers, which makes tracking more difficult and further reinforces the benefits associated with IoT/blockchain technology (Computer World, 2019). Consequently, global carriers equipped with IoT/blockchain capabilities will instantly become the preferred carriers of bio-pharmaceutical manufacturers. With the resources to establish a global network rooted in IoT/blockchain technology, by pro-actively pioneering these new blockchain regulations FedEx, UPS and DHL will be able to ensure that they retain their competitive moat in the expedited shipping industry. They will also create a new barrier for firms attempting to enter international expedited shipping, the arena where the majority of bio-pharmaceutical shipping takes place (TT News, 2019), further strengthening their ability to capture significant value from the growth of the pharmaceutical cold-chain industry.