Companies in the legacy energy sectors of oil, gas, and mining have been facing mounting criticism over the past decade as calls for swift and drastic action on climate change have intensified. While the world tries to find a balance between managing a rising global demand for energy and a daunting environmental crisis, these legacy sectors have struggled to maintain an investment-worthy image.

Now, decentralization of the industry and the introduction of blockchain technology have the potential to disrupt these industries even further. It appears that these sorts of innovations could finally galvanize widespread implementation of clean, localized, renewable energy sources (wind, solar, etc.) and could also provide consumers with increased visibility as to where their energy is coming from. It’s not all bad for the legacy energy sectors though as these innovations could, in turn, help them to reduce their emissions, to streamline their commodity supply chains, and to thereby lower costs. There are suggestions that blockchain technology investment in the energy sector could even grow at a 67% CAGR from 2019 to 2024[1].

So…are decentralization and blockchain going to be disruptive forces in the energy industry, or is it simply hype? This article will seek to highlight how companies can tackle challenges facing the legacy energy sectors by leveraging these innovations.

Product and Emissions Tracking

As mentioned, there is increasing pressure on legacy energy sector companies to reduce their emissions. Moving forward, investors, activists, and regulatory organizations alike are looking for companies to validate these reductions through trusted and verifiable tracking. Blockchain technology represents a way for energy companies to provide tamper-proof, auditable and transparent evidence of their works and associated emission statistics.

(Source: https://twitter.com/finboottech)

Spain’s Repsol, a major global oil and gas firm, has one of the most ambitious emission reduction targets in the industry, with a 2050 target of net zero emissions including all downstream customer use of their products. In order to monitor their progress, Repsol will require a comprehensive tracing and certification system for its petroleum products. As a result, they have actively engaged – and now invested in – Finboot, a start-up who offers blockchain as a service (BaaS) solutions[2]. The integration of Finboot’s MARCO software, using Ethereum, will allow Repsol to be one of the first major energy companies in the industry to be equipped to trace their products using blockchain technology.

With end consumers also taking an increasing amount of interest in the emissions of oil and gas companies, one can imagine a time where information about the specific origins and associated emissions of the petroleum being pumped at a gas station are publicly-available to consumers via a distributed ledger.

Another trend that has direct implications for the legacy energy industries is ESG investing. The trust bestowed in energy companies by consumers and investors has been eroding and is expected to cost each large oil company tens of billions of dollars[3]. Companies using blockchain technology to track their products and associated emissions will be a step ahead when it comes to validating their sustainability efforts to investors and re-earning the trust of the capital markets, especially in the context of new emission-based financial instruments. For example, the transition bond, a new kind of financial instrument, has been proposed as a way for traditional energy companies to receive funding that will be directly allocated to emission-reduction projects[4]. To secure this kind of investment, an oil and gas company will set out specific product lifecycle GHG emission reduction targets.

These instruments are still in their infancy, and currently have vague target requirements, but will certainly be much more clearly executable with the blockchain-backed tracking of oil and gas company emission statistics. Although capital investments in these industries are typically very heavily skewed towards the early stages and pre-production (construction of infrastructure prior to extraction of resources), there could potentially be financial instruments in the future that release capital to the firms based on milestone or checkpoint emission-reduction achievements directly through smart contracts.

Supply Chain Optimization

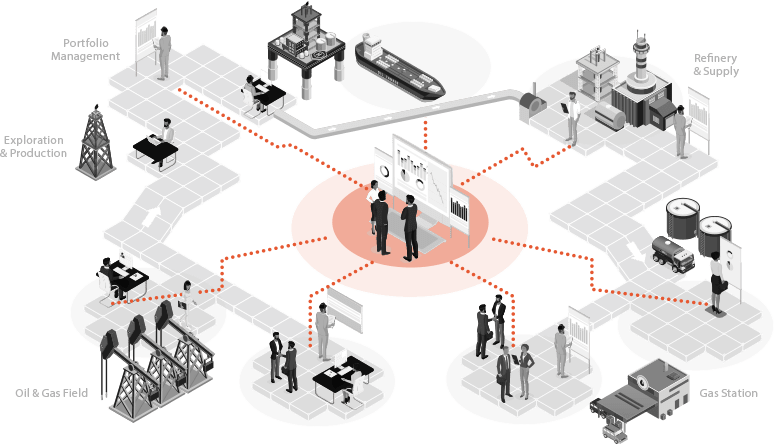

Major oil and gas companies manage intricate internal supply chains, which also involves external subcontractors especially at the exploration and production stages. (Source: https://aurosyssolutions.com/wp-content/uploads/2017/12/blockchain_oil_gas.png)

Blockchain technology solutions like Finboot also represent an opportunity for energy companies to optimize their physical and financial supply chains, and to save money in the process. Repsol estimates annual savings of $445K directly attributable to their Finboot implementation, not including the positive secondary impacts of this initiative on their investment attractiveness. The legacy energy sectors require the involvement of a comprehensive network of physical entities, with each step along the way consisting of its own regulation and set of processes.

Across the upstream, midstream, and downstream stages, a single drop of oil or gas can be subject to several hundreds of unique companies, regulatory and legal agreements, and processes. With so many stakeholders distributed across the value chain, many specialized short-term and long-term tasks have to be accomplished. Oilfield service companies, with all different types of specialties, typically work as subcontractors for the major oil companies.

In order to be compensated for their work, these companies must each attest to their responsibilities being completed, and this work has to be validated by the major company. This reconciliation typically takes weeks or months, and each subcontractor along the chain must attest to their work being done before the next one in line is eligible for reconciliation. These reconciliation delays can cause significant cash flow issues for the subcontractors. With blockchain technology, performance-based contracts (PCBs) could be generated. These PCBs would consist of a series of legally-enforceable smart contracts, whereby each subcontractor “attests” to their stage of the work being done by offering a “stake” (eg. money, a share of profit from the work completed, etc.) to the subsequent subcontractor down the supply or construction chain[5]. That subsequent subcontractor then validates the work of the previous, returns the “stake” to them, and can then begin their own stage of the work. With the work validated, final payment from the major to the previous subcontractor can automatically be completed. Alternatively, if the subsequent subcontractor argues that the work was in fact not completed, the two parties are required to resolve the issue amongst themselves without requiring the direct involvement of the major company.

PCBs would positively impact all stakeholders, as the major company would not need to personally validate each individual subcontractor’s work, instead relying on the decentralized process. The subcontractors would, in turn, receive validation of their work – and therefore financial reconciliation – much faster. The implementation of PCBs would represent a radical innovation in the oil and gas industry, as companies would require new technological competencies, but would be leveraging the existing business model. The innovation would simply help to expedite and streamline the currently cumbersome and inefficient process of reconciliation.

Conclusion

As you can see, the legacy energy sectors stand to benefit tremendously from the incorporation of blockchain technologies. Improved tracing and certification of natural resources, as well as emission statistics, presents the industry with an opportunity to impress both consumers and investors, and the decentralization of the reconciliation process represents one of the many ways in which these technologies could help to optimize the supply chain.

[1] https://www.businesswire.com/news/home/20190320005386/en/

[2] https://www.finboot.com/post/how-can-digitalisation-and-blockchain-help-oil-and-gas-companies-to-monitor-and-manage-their-climate-impact

[3] https://www.accenture.com/us-en/insights/strategy/trust-in-business

[4] https://smith.queensu.ca/centres/isf/pdfs/ISF-PrimerSeries-20190919-TransitionBonds.pdf

[5] https://insights.vertrax.com/blog/blockchain-transforming-upstream-oil-and-gas