By Brendan O’Sullivan

Investopedia defines a ‘decentralized market’ as one in which “technology enables investors to deal directly with each other instead of operating from within a centralized exchange.” (1)

New investment trading app Robinhood is adding to the growing number of online trading platforms forming a new decentralized investment market.

Founders Tenev and Bhatt, at Stanford University “selling trading software to hedge funds,” identified a problem with the American financial system; Wall Street firms were not charged to trade stocks, whereas your average American, up to $10 for every trade made. (2) Deciding together to democratize access to the system, the zero-commission concept for Robinhood was born.

Based on a “zero-commission fees” model, the app is designed to make trading accessible to tech-savvy millennials without a “central” broker working for a financial institution. Once signed up, users can invest in stocks, funds, and options in whole or fractional amounts.

Commission-Free Investing

As the title suggests, Robinhood enables its users to invest in U.S. stocks, bonds, funds, and cryptocurrencies independently. As a result, Robinhood users save on commission fees. This is the firm’s major point of differentiation and competitive advantage, and it forces established players such as Fidelity to lower their fees-for-service in the investment space. (3)

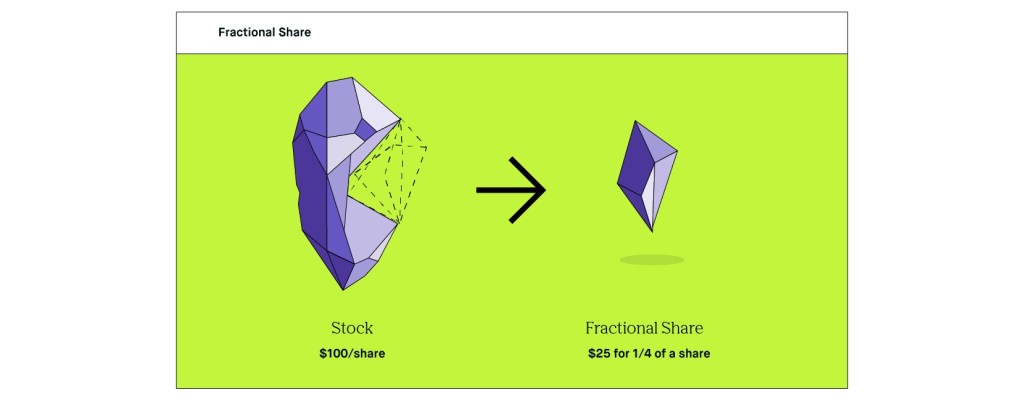

Fractional investment

Robinhood also offers fractional investing, which allows users who don’t have large amounts of cash to participate in financial markets as beginners, learning as they go in a low-stakes fashion. The ‘real-time’ operating window of Robinhood in whole or fractional format follows Investopedia’s definition of how decentralized markets work, “ [using] various digital devices to communicate and display bid/ask prices in real-time. In this way, buyers, sellers, and dealers do not need to be located in the same place to transact securities.” (4)

Other offerings

First off, simple, free financial knowledge spread in the form of original content from Robinhood editors (https://learn.robinhood.com.) (6) Secondly, an already 10 million-times-over-downloaded financial trends podcast called ‘Snacks’ (https://blog.robinhood.com) (7), along with a premium, market research based option. As of this year, Robinhood will be rolling out its DRIP (or Dividend Reinvestment Plan) and Recurring Investments, where users will be able to “automatically reinvest cash dividends back into [their] stocks and ETFs, and schedule recurring investments.” (8)

Crypto

In keeping with its millennial, disruptive, decentralizing nature, Robinhood now offers its users the chance to “buy & sell seven cryptocurrencies commission-free in 46 states and Washington, D.C.” (9)

An app-based bank offering?

As of early 2019, Robinhood submitted an application for a national banking charter in the United States’ Office of the Comptroller of the Currency (or OCC). (10)

Monetization

In simple terms; a) interest on non-invested cash, (b) Robinhood Gold, a margin trading service at $6 a month, and c) 2.6 cents per $100 on regulatory fees. (11)

Different strokes

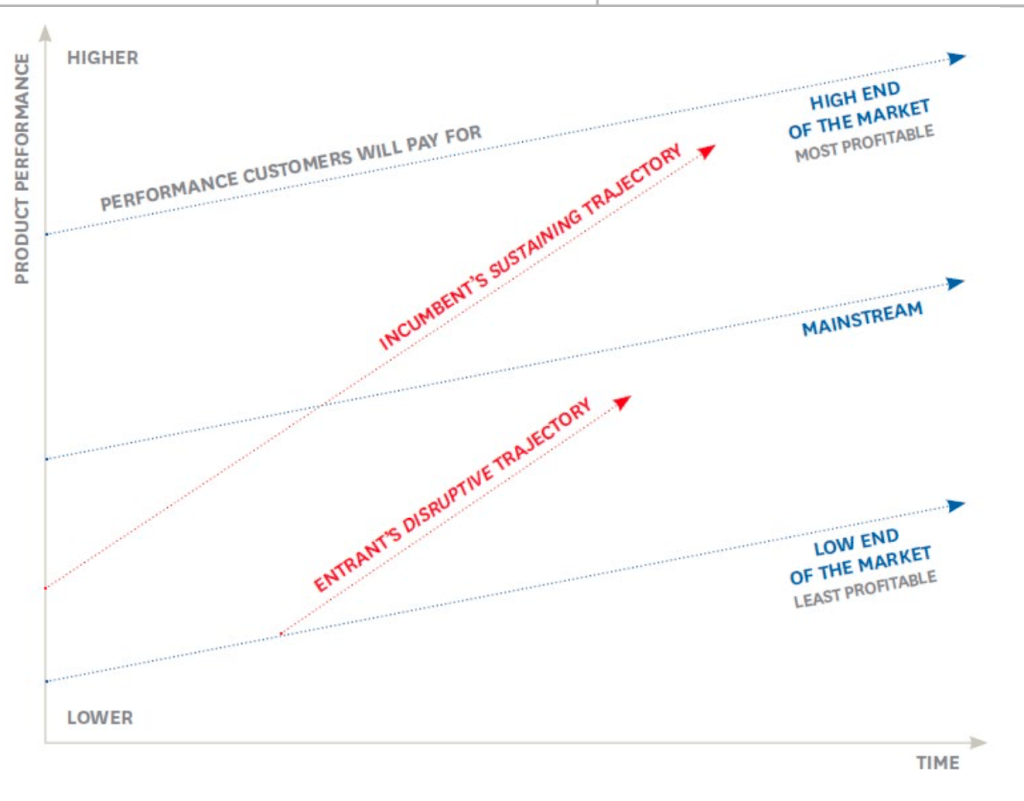

One key point Investopedia mentions is that trading with Robinhood doesn’t capitalize on price improvement opportunities (p.i.o.), where investors buy large chunks of shares (say a few hundred) low, sell higher (through a broker), and the money made offsets the commission costs associated. (12) This to me implies that Robinhood is better for the new investor beginning with small amounts of shares looking to get a feel for the system, and a firm like Fidelity, which specializes in p.i.o. deals, a logical next step. It also speaks to the innovator’s dilemma (13), where Robinhood is catering to the low end of the market, and a Fidelity, the higher end (the performance customers will pay for here refers to the p.i.os.)

Regulatory tension and the need for more clarity

Robinhood had promised no-fee chequing and savings accounts to users with as high as a 3% interest rate, only to go through a ‘product re-brand’ upon regulatory scrutiny from U.S. Senators and leaders of the SEC, FDIC and SIPC. The controversy centered around if customer funds would be properly insured as savings account funds are, or, if these accounts were seen by Robinhood to be brokerage cash management accounts (used to “hold cash until it can be invested in securities …[m]oney sitting in such accounts but not intended to buy securities may not be covered by the SIPC, which insures accounts for up to $250,000 of cash in the case of a broker’s failure.”) (14) The obvious abuse-potential here that organizations such as the SEC, FDIC and SIPC look to guard against would be if Robinhood were targeting non financially literate people who might not know that money in brokerage cash management accounts isn’t secured past a certain investment point.

“You’re reaching the people who tend to be unbanked and they might be less sophisticated financially, and not the people who would fully understand it,” Frank said. “There needs to be certainty — if there’s stuff that isn’t covered it needs to be in big bold on the top of the page. (former Republican Senator Barney Frank, co-author of the post financial crisis ‘Dodd-Frank’ reform act) (15)

Concluding thoughts

Robinhood, a disruptive platform akin to Napster or Spotify, has the potential to radically transform the U.S. financial services ecosystem. In our class we defined a platform as “a (digital) environment that connects individuals and organizations to share a common purpose or resource, characterized by near-zero marginal cost of access, reproduction, and distribution of information (“free, perfect, and instant”).”

Not only does the firm fit the above bills (no pun intended), it offers users the chance to trade for free, buy and sell cryptocurrency, and learn about finance both in theory and practice through its media publications and fractional investment platform. The bundling of all of these services for a post-2008 finance shy generation seems to make a lot of sense, and, if its project to become a national bank were to come through, a 3% interest rate would do wonders for growing the platform’s wider, mainstream base. Such a promised return, (higher than the U.S. Federal Reserve interest rate) for Frank (16) and others, begs the questions; how risky must the assets be that Robinhood is investing in in order to achieve this return? What safeguards are in place if they fail? Robinhood management providing answers surrounding these types of questions would enhance the firm’s wider public credibility.*

*As of today, Robinhood is offering a 1.8% interest rate, down from aforementioned 3%.

References

(1) https://www.investopedia.com/terms/d/decentralizedmarket.asp

(2) https://yucommentator.org/2019/02/robinhood-release-inner-investor/

(3) https://www.cnbc.com/2019/07/22/robinhood-lands-a-7point6-billion-valuation-after-recent-funding-round.html

(4) See ref. 1.

(5) https://learn.robinhood.com/articles/4EFqqbIXVM4mHEXqqlQAJe/what-is-a-fractional-share/

(6) https://learn.robinhood.com

(7) https://blog.robinhood.com

(8) Ibid.

(9) Ibid.

(10) See ref. 3.

(11) See ref. 2.

(12) https://www.investopedia.com/articles/active-trading/020515/how-robinhood-makes-money.asp

(13) J.P. Verge, Strategy in the era of Decentralization class (Ivey)

(14) https://www.cnbc.com/2018/12/20/senators-call-on-sec-and-other-financial-watchdogs-to-look-into-fintech-regulation-after-robinhood-debacle.html

(15) https://www.cnbc.com/2018/12/14/sipc-chief-raises-concerns-to-sec-about-robinhoods-free-checking-accounts.html

(16) Ibid.