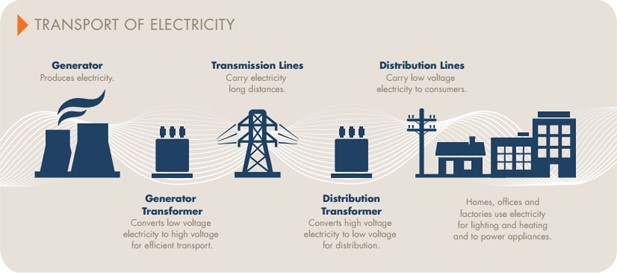

At the end of the 19th century, a technological battle for electricity dominance took place; Edison’s direct current (DC) electricity versus Tesla’s alternating current (AC) electricity. The result of the industry pioneers’ battle determined which electricity type would be used in power grids around the globe. The battle concluded due to a differing trait; DC electricity required it be generated within a couple miles of where it would be used to prevent significant electricity losses while transmitting, while AC electricity could be generated many hundreds of miles away without significant power losses during transmission. Due to that, AC electricity was adopted worldwide and became the standard for power generation; large, industrial power production plants, transmitting / distributing electricity over long distances. But a new sun is rising after 120 years: decentralized solar power production.

Diagram 1

Image sourced from Australian Energy Market Operator

Image sourced from Australian Energy Market Operator

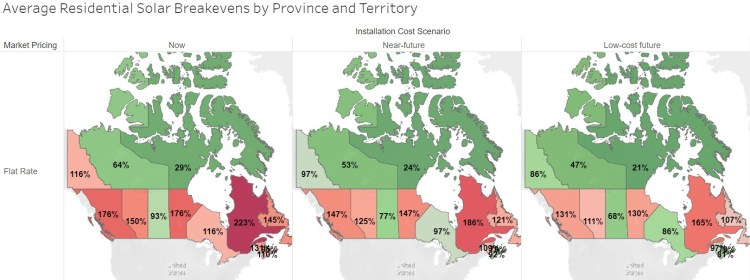

Value chains of power utilities have followed the same linear path for over a century (Diagram 1), but residential solar generation could change this. The Canada Energy Regulator (CER) recently published the Economics of Solar Power in Canada (ESPC) study which examined the “financial viability of typical solar power projects in over 20,000 Canadian communities. ESPC [did] this by estimating the amount and cost of electricity these projects might generate. It then [compared] these costs to local electricity prices to understand whether it makes financial sense to install solar.” The study calculated cost and benefits (excluding all rebate / incentive programs) and determined breakeven prices as a percent of electricity prices by region. The study’s residential investigation yielded the following results, where green means the benefits of installing a residential solar system outweigh the costs (Diagram 2):

Diagram 2

Image sourced from Economics of Solar Power in Canada

Image sourced from Economics of Solar Power in Canada

Let’s focus in on the slice of green in the middle, Saskatchewan.

With today’s electricity rates and installation costs, CER found that Saskatchewan residents installing solar panels will experience a positive financial return, while in the near future and in lower-cost future scenarios, residential solar generation becomes even more advantageous! With these financial incentives, Saskatchewan residential solar generation installations will increase. So, what is the impact on Saskatchewan’s primary supplier of electrical energy, SaskPower? Residences with private solar generation systems will purchase less power from SaskPower, causing a decrease in revenue for SaskPower. Unfortunately, SaskPower’s infrastructure requirements and costs will remain stable. Collecting less revenue while costs are unchanged is rarely desired, so what can SaskPower do about it?

Historically, SaskPower has supported residential solar power production through a net metering program where customers sold excess electricity produced by their solar generation systems to SaskPower. In addition, SaskPower offered a 20% rebate on the equipment and installation costs of solar generation systems (up to a maximum of $20,000), however the program was overhauled in 2019. SaskPower halved the sell-back rate and cancelled the equipment and installation rebate. The revised net metering program – although marginally beneficial – only offers support for residential solar power generation as opposed to embracing it. As SaskPower has a goal of having 50% of their power generation capacity come from renewable sources by 2030, (currently <25% of capacity is from renewable sources (Diagram 3), there may be an opportunity for SaskPower to imagine a new business model to use the soon-to-come wave of decentralized residential solar power generation.

Diagram 3 – SaskPower’s 2019 Generation Supply Mix

Image sourced from SaskPower – Balancing Supply Options

Image sourced from SaskPower – Balancing Supply Options

Let’s recall the first paragraph of this post regarding the battle between AC and DC electricity; AC won the battle because DC could not economically transmit electricity long distances. If an electricity company’s customers are generating power on their houses’ rooves, what impact could that have on the utility company? If the power company was able to harness this decentralized power production for their own benefit, then the need to build new power plants could be reduced, the expensive capital and maintenance requirements for transmission lines from those power plants would not be needed, and lastly, the percent of total generation by source would significantly increase toward solar power’s favour (and thus contribute toward a renewable target of 50%).

Before discussing options for SaskPower, let’s take a quick detour to examine another large-scale Canadian issue; housing affordability. The Government of Canada recognized that home ownership was becoming out of reach for many Canadians. To combat this issue, the National Housing Strategy released a disruptive innovation to assist homebuyers, called the First-Time Home Buyer Incentive (FTHBI). The incentive is a shared equity mortgage, where the Canadian Government takes a portion of the home’s equity in exchange for lending the Canadian five to ten percent of their prospective home’s purchase price. This lowers a purchaser’s borrowing requirements, making home ownership more attainable.

Through the FTHBI, the Canadian Government is attempting to address housing affordability through (1) a substantial financial commitment and (2) outside-of-the-box thinking. SaskPower is also facing significant challenges: aging infrastructure, residential uptake in solar generation chipping away at revenues, and attempting to hit the 50% power generation capacity from renewables by 2030 goal. Embracing the residential solar power generation is an opportunity for SaskPower to conquer its three challenges with one stone by applying the two concepts the FTHBI used; a substantial financial commitment and outside-of-the-box thinking.

SaskPower will spend $873M in capital expenditures in 2019-20, including over $200M on generation assets. SaskPower is not lacking in capital, rather it would be a matter of justifying an innovative idea to get the capital allocated to it.

For outside-of-the-box thinking, the sky is the limit. SaskPower could partner with residents to have excess solar generating capacity installed on their homes, therefore providing a material generation source for SaskPower. SaskPower could utilize a shared equity model, or a lease buy-back model to encourage installations at the pace which SaskPower has planned for. SaskPower could work with remote communities to create micro-solar grids with energy storage systems to eliminate the need for countless kilometers of power lines. Disruptive innovation to use decentralized solar power production could result in a multitude of unique ways to augment SaskPower’s value chain and business model, it just takes creativity and commitment.

Saskatchewan is Canada’s top province for solar energy potential, and with the goal of having 50% of SaskPower’s generation capacity come from renewables by 2030, solar power makes sense. There are additional solar industry obstacles, particularly power storage, but if the business model and value chain are critically examined, SaskPower could create a different business model, and create a global standard for how utilities can embrace decentralized electricity production and be this century’s Tesla.