Witnessing his mother suffer without access to a bank account, Oscar Garcia, Uulala’s CEO, identified the need for banking solutions for Latin Americas. With approximately 210 million unbanked adults in Latin America and 23 million in America (Source: Access Wire), Uulala’s mission is “to empower the unbanked through sustainable inclusion in the formal economy with financial technology and education.” (Source: Uulala) With the majority of the Latin demographic having access to a smartphone, Garcia saw the opportunity to use technology as an equalizer. Through its blockchain powered platform and app, the Uulala ecosystem consists of a mobile digital wallet, virtual debit card for online purchases, P2P payment remittances, micro-loans, and a credit score. Ultimately, by removing central authorities and third parties, Uulala’s decentralized model allows the Latin community to move away from a cash-based culture to one that focuses on credit and empowerment through financial inclusion.

What is Uulala trying to solve?

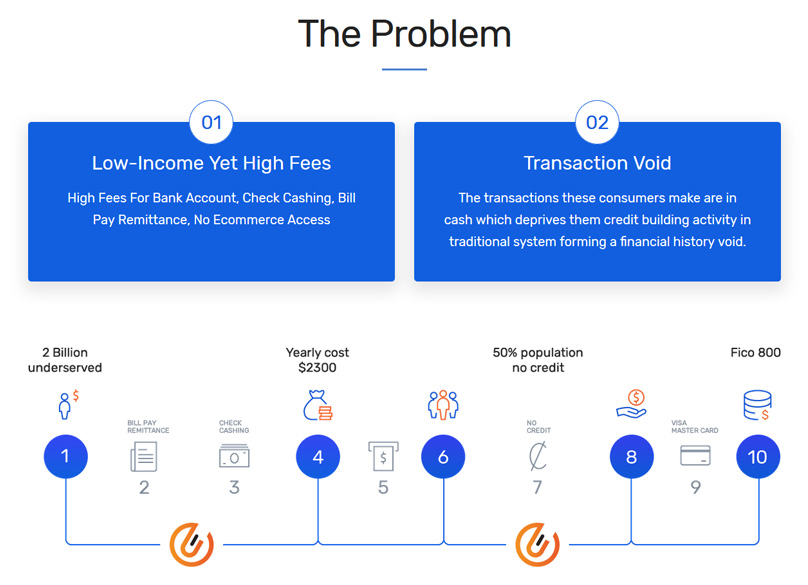

There are two major issues that Uulala is attempting to resolve (Source: Blockonomi). First, fees such as cheque cashing, monthly maintenance, and remittance represent significant barriers to banking services for low income individuals. Uulala is able to reduce fees in the ecosystem as it is not reliant one a single product. Second, Uulala’s goal is to eliminate the “transaction void.” In emerging markets, consumers tend to make majority of their transactions in cash, limiting their ability to build credit. Through the Uulala platform, consumers are now able to make their daily transactions on the app and in turn build a credit history. This will facilitate financial inclusion as individuals can participate in the formal economy through activities such as taking out a loan to fund their business.

Source: Blockonomi

Part of Uulala’s success can be attributed to its organizational structure. With a minority-based management team, the individuals at Uulala understand the pain points of the unbanked. As first- and second-generation Latin Americans, they have lived the struggles of their target demographic, allowing them to create a platform that truly addresses the needs of this group.

WHERE DOES BLOCKCHAIN FIT IN?

At the core of Uulala’s business model is the open source blockchain technology that has enabled the platform to create credit profiles for the unbanked. At a high level, consumers use the platform on a daily basis to make transactions such as remittances and bill payments. The transactions are recorded on a blockchain ledger and are verified for accuracy and validity. Using this data, Uulala employs its in-house algorithm to forecast a customer’s creditworthiness. By building a credit profile for each consumer, Uulala is able to provide low-interest microcredit loans to those who are traditionally underserved by large financial institutions (Source: Medium). Furthermore, through its partnerships with various financial institutions, Uulala allows consumers to use their blockchain generated credit score outside of the platform, eliminating a barrier for crucial financial decisions. The platform combines a decentralized database with a system to track a consumer’s financial activities in order to monitor the creditworthiness of a consumer.

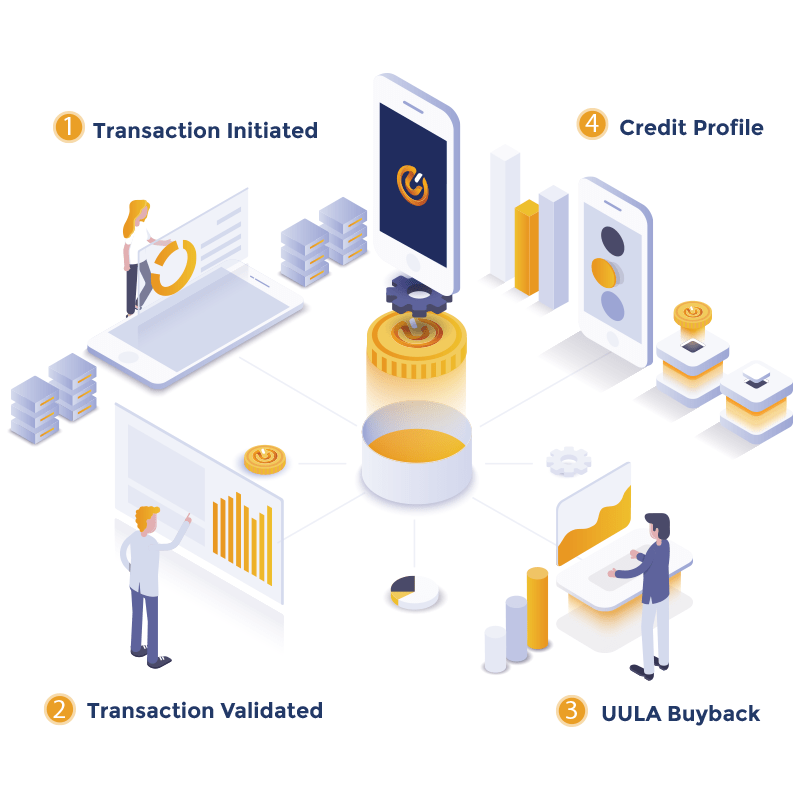

Taking a deeper look into the Uulala ecosystem, Uulala’s digital asset, UULA, is vital to the blockchain based credit profiles. Data from the financial transactions are encrypted and the hash is stored inside the digital asset. The asset logs the transactions on the Uulala blockchain, which is used to create the credit profile for the users. Uulala’s ability to create its own blockchain enables the platform to avoid any unnecessary fees, which in turn allows the firm to solve one key issue associated with traditional banking: high fees. Below is a visual representation of the UULA ecosystem.

Source: Uulala Website

Within the platform, the Uulala customer will first initiate a financial transaction. The transaction will then be validated. Post validation, Uulala buys back an UULA from asset holders. This is where the encrypted metadata is stored. Lastly, the UULA digital asset logs the data to the Uulala blockchain to create the credit profile (Source: Uulala).

WHAT KIND OF INNOVATION IS UULALA?

Uulala’s new business model, coupled with its new technical competencies highlight that the platform is an architectural innovation. The platform targets an underserved demographic – Latin Americans and minorities that are unbanked. With a high proportion of the demographic unable to develop a credit score, current market incumbents, traditional financial institutions, have largely discounted this segment. Uulala’s use of its proprietary algorithm and blockchain technology required the organization to develop new technical competencies to address the concerns and gaps facing the Latin American community.

WHO BENEFITS FROM UULALA?

The majority of the value created from Uulala’s platform is captured by the users of the app. The barriers to financial inclusion are reduced through lower fees and access to an array of services. Essentially, consumers do not need to adapt to any major changes. Rather than using cash, they simply use the Uulala app to complete their daily transactions. Users can continue making their regular purchases but are now able to capture more value. Using Uulala’s platform allows consumers to not only benefit from lower fees, but gives them the ability to build a credit history and opens opportunities to additional financial services such as loan from large institutions. Although users gain most from Uulala, value is also captured by traditional financial institutions. With the greater transparency and traceability associated with blockchain, financial institutions can benefit from the data and credit profiles generated by Uulala in order to serve a new demographic. Uulala enables financial institutions to become more comfortable and confident in providing loans and services to the current unbanked Latin American and minority populations.

Overall, Uulala has proven to be a prime example of how a decentralized model through the use of blockchain can be used for social good. Empowering those in the emerging markets through the creation of a credit profile opens plenty other opportunities that these individuals did not have access to before. Keeping in mind the United Nation’s Sustainable Development Goals, financial inclusion through a platform such as Uulala can be a means of eradicating poverty (Goal #1: No Poverty). Uulala allows for us to become one step closer in reaching this goal.