Informality in Peru represents 40%[1] of the economy with an approximate value of US$ 89 billion or US$ 7k per capita considering 2018 GDP values [2]. Even though the Peruvian government has made many efforts to fight informality and try to bring people to the formal economy, the policies haven’t work as expected since informality is a complex problem that also involves education and culture. Informality prevents people from getting benefits and protection that the government can provide[3] and prevents the government to obtain more resources through taxes, reducing the country´s expectation of future growth.

As a result of informality, financial inclusion in Peru measure by the number of people with an account in the banking system with respect to the adult population is 42 %, a very low percentage compared with neighbor countries such as Chile and Brazil with a 74% and 70% respectively[4].

In this environment, since 2015 the Peruvian Government has been implementing the Financial Inclusion National Strategy with the goal of obtaining results on three dimensions: access, usage and quality.[5] In addition, many banks in Peru have started to make significant investments in their digital platforms to improve its clients experience but also to attract new costumers who do not currently use the financial system, expanding their digital channels instead of their physical branches.

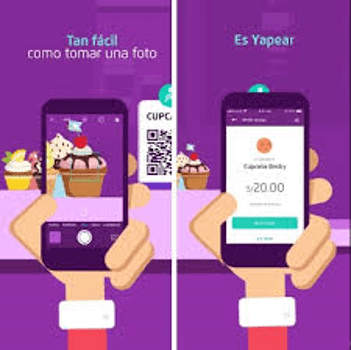

The leader bank in Peru, BCP has been making significant investments in tech innovation of around US$ 100 MM in 2018[6]. BCP has been working with fintechs through collaboration agreements [7] and its internal innovation center. In 2016, BCP introduced YAPE, an app to transfer money (up to US$ 150) using only the contacts numbers on your cellphone, offering save transactions with no commission. This was revolutionary for the Peruvian banking system since in Peru in order to transfer money to someone else you needed to provide a banking account number. In 2019, the application included a new feature that introduced a QR code instead of using a cellphone contact number and allows users of the app to made payments to establishments that had a QR code[8]. This was also a very important milestone since most people in Peru will do every day low amount transactions using cash to pay for services and goods in small and medium size business establishments. Since its operations began, YAPE has transferred US$ 132 MM[9] and has 2 MM people using the app[10]. This is a significant number considering that in Peru there are only 11MM people who uses the banking system[11] from a total population of 32 MM people in the country.

Another characteristic of the Peruvian economy is dollarization. According to the Peruvian Central Bank (BCRP), in 2008 the coefficient of dollarization in Peru was around 28%[12]. The use of US dollar in the Peruvian economy is still high and is the result of previous inflationary recessions that forced people to migrate to a safer currency: US-dollars instead of the Sol[13]. People will use dollars as a currency for rent, real estate transactions, car transactions and others.

The fintech KAMBISTA took advantage of this opportunity and in 2017 began operations in the Peruvian market offering digital money exchange services at competitive prices[14]. Banks usually do not offer competitive prices on money exchange and the other alternative that do offer competitive prices require going to a physical money exchange establishment or using a “cambista”[15] service on the street. The last two are not very secure since people will be carrying cash and become the target of armed thieves. To date, KAMBISTA has exchange US$ 443 MM with more than 260k operations and 64k registered users[16].

These fintech innovations have decentralized transactions that could only have been done through banks or using cash, offering low cost and more convenience for the user. These apps keep the security that a bank can offer in terms of data security and the reduction of the use of cash that can be unsafe to carry around. In addition, fintechs can benefit from the information provided by these apps by identifying customer consumption and small and medium size business income, making it easier to offer additional specific products and benefits to their customers in the future and including them in the formal economy.

[1] Leandro Medina and Friedrich Schneider. Shadow Economies Around the World: What Did We Learn Over the Last 20 Years?. International Monetary Fund. 2018.

[2] Banco Central de Reserva del Peru (BCRP). Peru in figures. 2019. https://www.bcrp.gob.pe/eng-docs/Statistics/quarterly-indicators.pdf

[3] Norman Loayza. The causes and consequences of informality in Peru. Banco Central del Perú. 2007.

[4] Superintendencia de Banca, Seguros y AFP (SBS). PERU: Reporte de indicadores de inclusión financiera de los sistemas financiero, de seguros y de pensiones. 2009

[5] SBS. National policy Website. http://www.sbs.gob.pe/inclusion-financiera/Politica-Nacional

[6] BCP Annual Report 2018.

[7]José Carlos Reyes. Gestión. BCP prevé cerrar convenios de colaboración con cinco nuevas fintech este año. 2019. https://gestion.pe/economia/empresas/bcp-preve-adquirir-cinco-nuevas-fintech-ano-264425-noticia/

[8] Katherine Maza. Yape: Aplicativo permitirá pagar en comercios con código QR desde este mes. El Comercio web. 2019. https://elcomercio.pe/economia/negocios/yape-bcp-aplicativo-permitira-pagar-comercios-codigo-qr-visa-mes-noticia-643953-noticia/

[9] Katherine Maza. Yape: Aplicativo permitirá pagar en comercios con código QR desde este mes. El Comercio web. 2019. https://elcomercio.pe/economia/negocios/yape-bcp-aplicativo-permitira-pagar-comercios-codigo-qr-visa-mes-noticia-643953-noticia/

[10] BCP webpage https://www.viabcp.com/canales/yape

[11] PeruRetail Web. ¿Sabías que podrás “yapear” sin ser cliente del BCP?. 2019. https://www.peru-retail.com/peru-sabias-que-podras-yapear-sin-ser-cliente-bcp/

[12] BCRP. Reporte de Inflación. Marzo 2019.

[13] Sol is the current Peruvian currency

[14] Peru.com. Kambista: así funciona la aplicación móvil para el cambio de monedas. 2018

[15] “Cambista” is a person that exchanges money on the streets. They usually have a permit to do so and offer a very good exchange rate

[16] Kambista webpage. https://kambista.com/